Introduction: A $200+ Billion Industry at a Crossroads

The global laundry detergent market, valued at $205 billion in 2024, is undergoing its most significant transformation in decades. From sustainability pressures to format wars and regional disparities, industry players face both unprecedented challenges and lucrative opportunities.

Section 1: Current Market Landscape

By the Numbers (2024)

| Metric | Value | Growth Driver |

|---|---|---|

| Total Market Size | $205B | Population growth + rising hygiene standards |

| Liquid Detergents Share | 58% | Emerging market preference |

| Pods & Sheets Share | 23% | Western convenience culture |

| Powder Detergents Share | 19% | Price sensitivity in developing nations |

Regional Breakdown:

- Asia-Pacific: 42% of global demand (China + India = 65% of regional sales)

- North America: $28B market, but stagnant (1.2% CAGR)

- Europe: Sustainability leader, but lowest per-capita consumption

Section 2: Key Market Drivers

1. The Sustainability Paradox

- Consumer Demand: 68% claim eco-friendliness influences purchases (Nielsen 2024)

- Reality Check: Only 12% of major brands use >50% recycled packaging

- Regulatory Pressures:

- EU’s Detergent Regulation (EC) No 648/2004 updates (2025)

- California’s SB-54 mandates 30% PCR plastic by 2025

2. The Format Wars

- Pods Peaking? 12% growth slowing to projected 7% by 2026

- Liquids Resurgent: New ultra-concentrates cutting shipping costs by 40%

- Dark Horse: Dissolvable sheets (300% YOY growth from small base)

3. Regional Oddities

- India’s Sachet Economy: 5ml single-use packs dominate (78% of sales)

- Japan’s Detergent Sheets: Already 15% of market, outpacing pods

- Africa’s Powder Stronghold: 89% market share due to hard water conditions

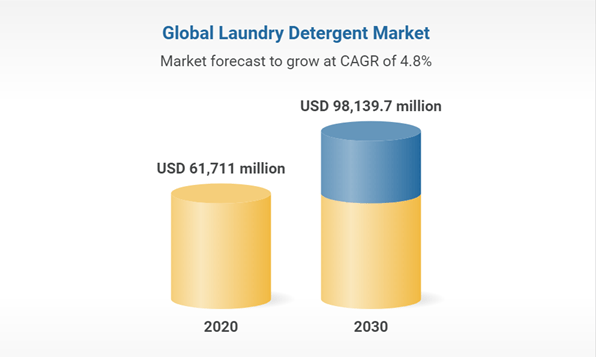

Section 3: Future Outlook (2025-2030)

Game-Changing Technologies

- Enzyme Breakthroughs

- Novozymes’ “KillSwitch” enzymes self-deactivate post-wash (50% less water pollution)

- Expected to capture 8% of industrial detergent market by 2027

- Waterless Formulations

- Unilever’s “Dirt Grab” technology (spray-on, wipe-off detergent)

- Pilot tests show 90% less water usage vs traditional washes

- AI-Optimized Dosing

- Samsung’s Smart Detergent Dispenser reduces usage by 35%

- Threatens bulk detergent sales in smart-home markets

Market Projections

| Region | 2024 Market Share | 2030 Projection | Key Trend |

|---|---|---|---|

| Asia-Pacific | 42% | 49% | Rural penetration + sachet economics |

| Africa/Middle East | 8% | 12% | Population boom + urbanization |

| North America | 14% | 11% | Format saturation + regulation costs |

Conclusion: 3 Strategic Imperatives

- Diversify or Die

- Single-format brands risk obsolescence (e.g., Purex’s powder collapse)

- Winning Example: Henkel’s simultaneous investment in pods, sheets, and refill stations

- Localize Everything

- R&D: Formulate for regional water hardness (e.g., Africa’s calcium-rich water)

- Marketing: India’s sachets won’t sell in Germany’s refill culture

- Embrace the Detergent-As-A-Service Model

- Opportunity: Smart dispensers with subscription refills (25% higher CLV)

- Threat: Amazon’s private label could dominate this space by 2026

The next detergent billionaires won’t sell cleaner clothes—they’ll sell smarter, greener, and more convenient cleaning solutions.