A Practical Decision Framework for Private Label, Import & Retail Sourcing Teams

In the laundry category, retail buyers are under constant pressure to lower shelf prices while protecting margins. As a result, sourcing discussions often begin — and end — with unit price: cost per bottle, cost per box, or cost per carton.

However, buyers with long-term category responsibility know that unit price rarely tells the full story.

Across private label programs, national retail chains, and institutional supply contracts, one metric consistently proves more reliable for decision-making and risk control:

Cost per wash.

Retail buyers who understand and actively manage cost per wash make more stable sourcing decisions, reduce post-launch issues, and protect margins in a category where consumer complaints and price sensitivity can quickly erode profitability.

This article explains what cost per wash really means for retail buyers, how it should be evaluated, and why manufacturers and OEM partners play a much larger role in this metric than most buyers expect.

1. What Cost per Wash Actually Means in Retail Sourcing

Cost per wash is the real cost incurred for one standard laundry cycle, based on correct usage under normal consumer conditions.

Unlike unit price, cost per wash reflects:

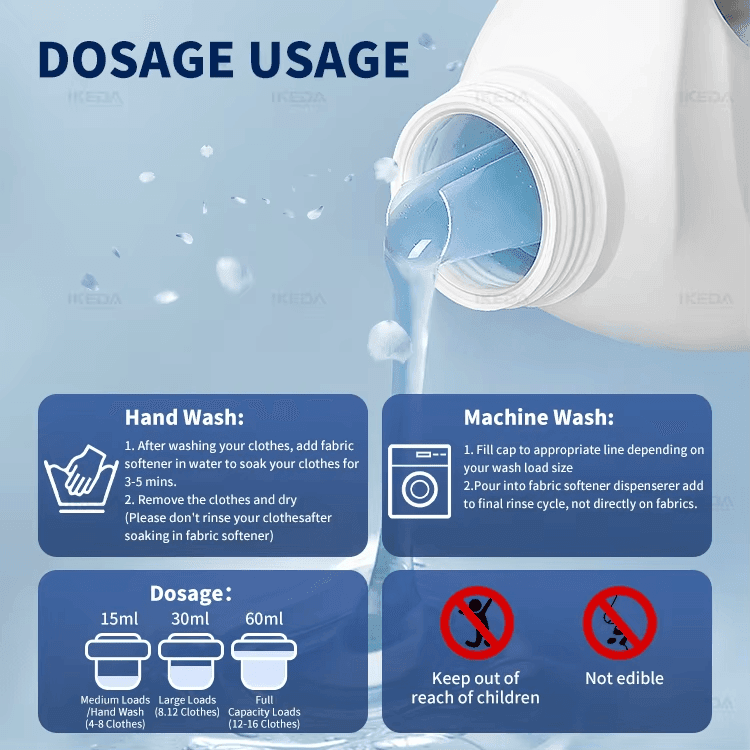

- Recommended dosage

- Product concentration level

- Format-related usage behavior

- Packaging design and dosing accuracy

For retail buyers, this metric matters because it directly influences:

- Consumer value perception

- Repeat purchase behavior

- Complaint and return rates

- Long-term category performance

A product that looks competitive at shelf level can still perform poorly if consumers feel it “runs out too fast” or delivers inconsistent results.

Cost per wash exposes these risks before they appear in sales data or customer reviews.

2. Why Unit Price Alone Leads to Cost Misjudgment

Unit price dominates early-stage sourcing because it is easy to compare. Unfortunately, it also hides some of the most common cost failures in the laundry category.

Retailers frequently encounter issues such as:

- Liquid detergents being overdosed by consumers

- Inconsistent wash results due to variable usage

- Faster-than-expected depletion rates

- Negative feedback related to “poor value for money”

Once these issues appear post-launch, the cost impact multiplies:

- Increased customer service workload

- Higher return and refund rates

- Pressure to discount or reformulate

- In extreme cases, SKU delisting

Cost per wash helps retail buyers identify these risks during sourcing, not after launch.

3. Cost per Wash: A Practical Calculation Framework

While exact formulas vary by product, experienced buyers evaluate cost per wash using a simple logic:

Cost per wash = Product cost ÷ Realistic number of effective washes

What matters is not the theoretical maximum number of washes printed on the label, but:

- Realistic consumer dosing behavior

- Performance consistency at recommended dosage

- Stability of usage across different households

This is why cost per wash is not purely a pricing metric — it is a product design outcome influenced by formulation, format, and packaging.

4. How Product Format Shapes Cost per Wash

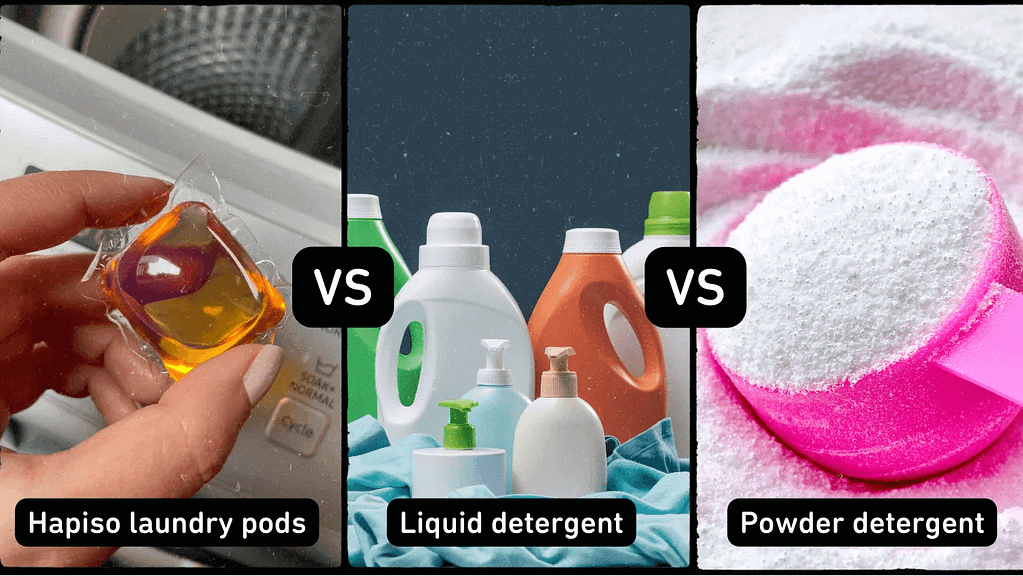

Different laundry formats behave very differently in real-world use.

Liquid Detergent

- Dosage controlled by the user

- High likelihood of overuse

- Cost per wash varies widely

- Value perception depends heavily on consumer habits

Laundry Pods

- Pre-measured dosage

- Consistent performance per cycle

- Predictable cost per wash

- Lower misuse and complaint risk

For retail buyers managing private label programs, predictability is critical. Products with stable cost per wash reduce variability across households and markets, making performance easier to communicate and manage.

This is why many retailers introduce laundry pods first when building new private label laundry ranges, even if liquids remain important for volume.

5. Concentration Level: The Hidden Cost Driver

Two products with similar shelf prices can deliver very different cost per wash outcomes due to concentration.

Key influencing factors include:

- Active ingredient density

- Water content

- Surfactant efficiency

- Enzyme performance at lower temperatures

Highly concentrated formulations typically:

- Require smaller dosages

- Deliver more effective washes per unit

- Reduce freight cost per active dose

- Improve shelf-space efficiency

For retail buyers, concentration should be evaluated alongside pack size, not after it.

6. Logistics and Cost per Wash: An Overlooked Connection

Cost per wash does not stop at formulation — it extends into logistics and landed cost.

Products with high water content:

- Weigh more per effective wash

- Occupy more container space

- Increase freight cost volatility

- Compress margins during shipping fluctuations

Concentrated detergents and laundry pods:

- Reduce shipping weight per wash

- Improve pallet and container utilization

- Stabilize landed cost across markets

For retailers sourcing internationally, especially from Asia into Europe or North America, this logistics efficiency often determines whether margins remain predictable over time.

7. The Manufacturer’s Role in Cost per Wash Optimization

Retail buyers often assume cost per wash is fixed once a quotation is issued. In reality, manufacturers influence this metric at multiple levels.

At the OEM and ODM laundry manufacturing services stage, cost per wash can be optimized through:

- Balanced surfactant systems rather than higher dosage

- Enzyme selection that performs well at lower temperatures

- Controlled fragrance release instead of over-perfuming

- Packaging designs that support accurate, repeatable dosing

Manufacturers with strong R&D and production control can often improve cost per wash without increasing unit price, simply by improving formulation efficiency.

This is why OEM capability matters as much as price negotiation.

8. Cost per Wash and Consumer Trust

From a consumer perspective, cost per wash directly shapes perceived value.

When expectations are met:

- detergent labeling and compliance requirements

- Repeat purchases increase

- Brand trust strengthens

When expectations are missed:

- “Not worth the price” reviews appear

- Brand switching accelerates

- Retailers face margin pressure through discounting

Retail buyers who manage cost per wash effectively protect not only margins, but also brand credibility — especially in private label programs where the retailer’s name is on the package.

9. Cost per Wash in Private Label Decision-Making

In private label sourcing, cost per wash becomes even more critical.

Retail buyers must balance:

- Competitive shelf pricing

- Acceptable gross margins

- Consistent consumer experience

Products with unstable cost per wash often lead to:

- Reformulation requests

- Packaging changes

- Relaunch costs

- Supply chain disruption

Optimizing cost per wash early — during formulation and packaging design — significantly reduces these downstream risks.

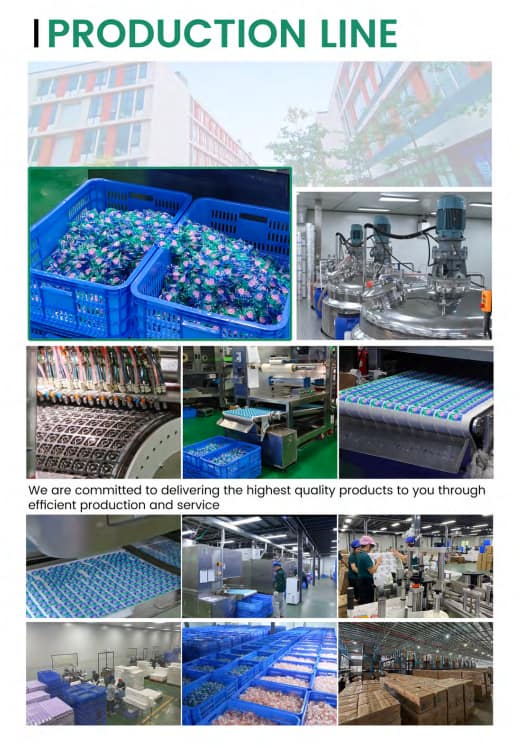

Experienced laundry detergent Manufacturers such as IKEDA, with long-standing experience in household cleaning product OEM and ODM services, support retail and wholesale partners by modeling cost per wash during pre-production stages, helping buyers launch products that perform consistently in real market conditions.

10. How Retail Buyers Should Use Cost per Wash in Sourcing

Best practices among experienced retail buyers include:

- Requesting dosage-based cost comparisons from suppliers

- Evaluating formats on a per-wash basis, not per unit

- Including logistics cost per wash in landed cost analysis

- Considering complaint and misuse risk as part of value assessment

When cost per wash becomes part of the sourcing conversation, negotiations shift from price-driven to value-driven — leading to more sustainable supplier relationships.

Conclusion: Buy Laundry Products the Way Consumers Use Them

Laundry products are not consumed by the bottle or the box.

They are consumed by the wash.

Retail buyers who evaluate products through the lens of cost per wash align sourcing decisions with real consumer behavior, logistics realities, and long-term category performance.

In a highly competitive laundry market, cost per wash is no longer a technical detail — it is a strategic buying metric.