A B2B Decision Guide for Importers, Distributors & Private Label Brands

For wholesalers operating in today’s laundry care market, the choice between laundry pods and liquid detergent is no longer about consumer preference alone. It has become a strategic decision tied directly to cost control, logistics efficiency, and margin sustainability.

Rising freight costs, raw material volatility, and increasing retailer pressure are forcing distributors to reassess their product mix. Understanding the true cost and margin structure behind each format is essential for wholesalers aiming to scale profitably.

This article provides a manufacturer-informed comparison of laundry pods versus liquid detergent—focusing on cost per wash, shipping efficiency, wholesale margins, and private label scalability.

1. Market Context: Why Wholesalers Are Rethinking Detergent Formats

In many regions, liquid detergent remains the volume leader. However, growth patterns are shifting:

- Retailers are demanding higher margins per SKU

- Logistics costs are absorbing a larger share of landed cost

- Consumers are trading up to premium, convenient formats

As a result, wholesalers are increasingly evaluating laundry pods as a margin-stabilizing alternative, particularly for export and private label programs.

From a manufacturing perspective, this shift is not accidental—it reflects structural differences in how each product format performs across the supply chain.

2. Unit Price vs Real Cost: Where Many Margin Calculations Fail

At quotation stage, liquid detergent often appears cheaper than laundry.

However, experienced wholesalers know that unit price rarely reflects real cost.

Cost per wash has become a key metric for professional buyers, as dosage accuracy directly affects both consumer satisfaction and long-term margins.

Industry research on detergent formulation and dosing consistency confirms that pre-measured formats reduce cost variability across distribution channels.

Professional buyers evaluate:

- Dosage consistency

- Freight cost per wash

- Packaging efficiency

- Inventory turnover risk

In practice, many margin miscalculations happen because liquid detergent costs look attractive on paper but erode during distribution.

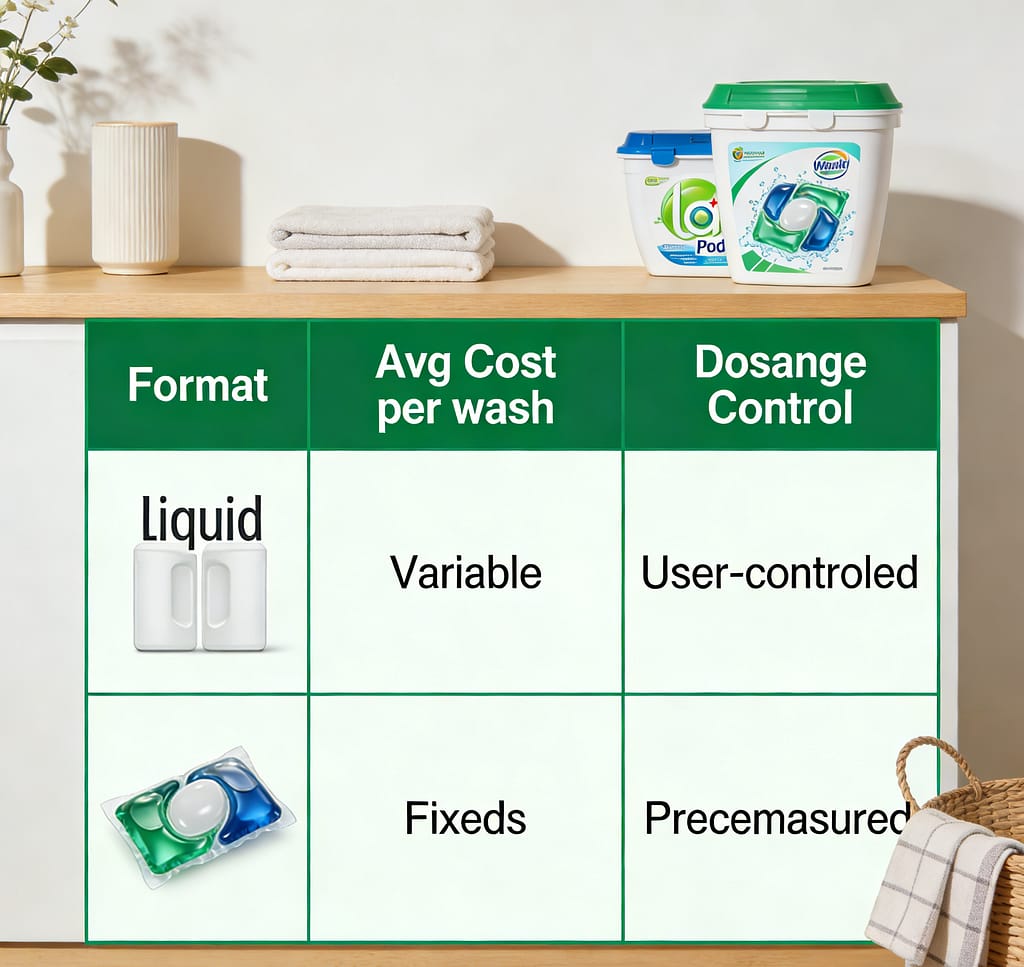

3. Cost per Wash: The Metric Professional Buyers Trust

Liquid Detergent

- User-controlled dosing

- High likelihood of overuse

- Variable cost per wash

Laundry Pods

- Pre-measured dosage

- Consistent performance

- Predictable cost per wash

For wholesalers supplying retail chains or institutional buyers, cost predictability is critical. Complaints, returns, and margin leakage often originate from inconsistent dosing—an issue pods inherently solve.

From our experience working with international distributors, many discover only after their first shipment that pods deliver a more stable cost-per-wash model, despite higher per-unit pricing.

4. Logistics & Shipping: Structural Advantages of Laundry Pods

Logistics has become one of the most decisive cost factors in detergent wholesaling.

According to global freight cost analysis for FMCG products, shipping weight and container utilization play a critical role in landed cost per unit.

Liquid Detergent Logistics Challenges

- High water content

- Heavy gross weight

- Lower container utilization

- Higher freight cost per wash

Laundry Pods Logistics Advantages

- Highly concentrated formulations

- Lower shipping weight per active dose

- Compact packaging formats

- Improved pallet and container efficiency

For export-focused wholesalers shipping to Europe, North America, or Southeast Asia, laundry pods often reduce landed cost volatility significantly.

Manufacturers such as IKEDA design pod formulations specifically to optimize active concentration and packaging density, helping wholesalers control freight-related margin erosion.

5. Wholesale Margin Structure: Liquids vs Pods

Liquid Detergent

- Highly competitive, price-driven category

- Limited differentiation at shelf level

- Margins under constant pressure

Laundry Pods

- Strong premium perception

- Easier brand storytelling (convenience, fragrance, performance)

- Higher accepted retail price points

For private label programs, pods frequently offer:

- Higher gross margin per SKU

- Faster brand differentiation

- Lower price sensitivity at retail

This explains why many wholesalers introduce pods first when developing new private label laundry products, using liquids later for volume expansion.

For export-focused wholesalers, laundry pods offer structural logistics advantages. View private label laundry pods

6. Private Label Scalability: OEM & ODM Considerations

Scalability is often underestimated during product selection.

OEM partners with modular production capabilities enable wholesalers to scale private label programs with lower risk.

Liquid Detergent

- Larger storage footprint

- More packaging variants

- Higher leakage risk during transit

Laundry Pods

- Modular packaging solutions

- Easier fragrance-based SKU expansion

- More efficient phased market testing

From a manufacturing standpoint, pods allow OEM partners to offer flexible MOQs, enabling wholesalers to validate market response before scaling.

IKEDA supports both OEM and ODM models, allowing B2B buyers to start with proven pod formulations and gradually introduce customized fragrance or performance upgrades as volumes grow.

7. Risk Factors Wholesalers Must Evaluate

Liquid Detergent Risks

- Leakage and packaging damage

- Higher return rates

- Dosage-related consumer dissatisfaction

Laundry Pod Risks

- Film dissolution quality

- Moisture sensitivity

- Requires strict manufacturing control

These risks are not inherent flaws—but manufacturing competence issues. Working with an experienced laundry pods OEM manufacturer reduces dissolution failures, quality complaints, and post-launch disruptions.

8. Compliance & Market Acceptance

Both formats must comply with:

- EU & UK detergent regulations

- IFRA fragrance standards

- Market-specific labeling requirements

However, pods often face additional scrutiny, making regulatory documentation and formulation validation essential.

Manufacturers like IKEDA provide market-ready compliance support, helping wholesalers avoid delays in customs clearance or retail onboarding.

9. Strategic Recommendation for Wholesalers

There is no single correct choice—but there is a strategic framework.

Liquid Detergent Works Best When:

- Competing in price-driven local markets

- Freight costs are minimal

- High-volume SKUs dominate

Laundry Pods Are Ideal When:

- Exporting internationally

- Targeting mid-to-premium retail segments

- Prioritizing predictable cost per wash

- Developing private label brands

Many successful wholesalers ultimately carry both formats, using pods for margin optimization and liquids for volume stability.

Conclusion: Choose Based on Margin Structure, Not Habit

For wholesalers, the pods vs liquid detergent debate should not be guided by tradition or unit pricing.

Instead, focus on:

- Cost per wash

- Logistics efficiency

- Retail margin sustainability

- Private label scalability

With the right OEM partner, both formats can be profitable. However, in a logistics-driven global market, laundry pods increasingly provide structural advantages for B2B buyers.

With over 20 years of experience in household cleaning product manufacturing, IKEDA supports wholesalers and brand owners worldwide with OEM/ODM laundry solutions designed for export efficiency, compliance, and long-term margin growth. Contact IKEDA to evaluate laundry pod vs liquid detergent solutions for your market.

Q: Are laundry pods more expensive for wholesalers?

A: On a per-wash basis, pods often deliver more stable margins.